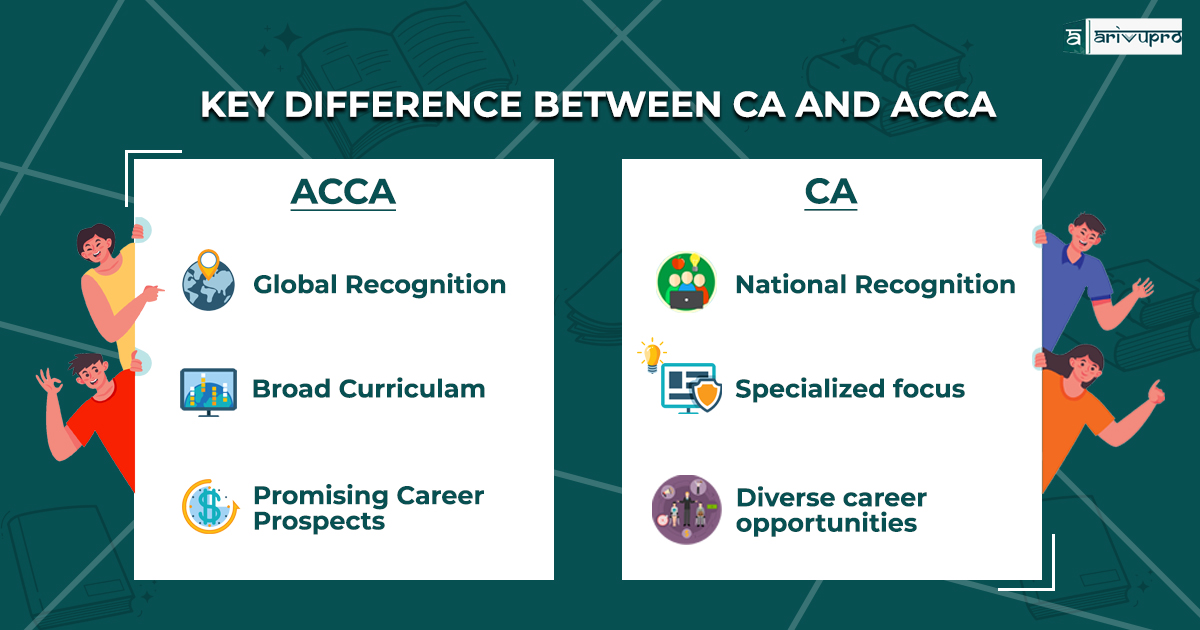

ACCA (Association of Chartered Certified Accountants) is a globally recognized institution in the accounting and finance industry. As part of this profession, it concentrates on auditing financial records, investing in financial anomalies, forecasting financial data, and developing and maintaining financial systems. ACCA is the perfect choice for those students interested in making a career in financial management. It gives students knowledge about finance and accounting, and it is perfect for those seeking overseas employment.

A CA (Chartered Accountant) specializes in accounting, taxation, and finance. CA is the one who takes care of budgets, provides trustworthy information about finance, and also helps with business strategies. CA is a profession that demands respect and high pay.

CA is considered a tough course compared to others, but it is the most valuable and prestigious course that one can pursue. But CAs are the highest-paying jobs in India. So it is always a great choice to choose CA.

Can you choose between ACCA and CA for your career?

If you want to make your career in the field of Finance and Accounting then ACCA and CA are the best options you have. Now the main question comes here, do you want to make your career in India or Abroad, keeping this answer in mind while selecting the course is crucial. If you are willing to make your career in India, Then CA is the best option you can select Because Indian firms will usually want CAs to prepare and audit their financial records and CAs will be having the best knowledge about tax, laws, and the Indian economy. Similarly, if you want to settle in Abroad then ACCA would be the best choice, as it is recognized worldwide.

ACCA and CA eligibility criteria

ACCA: To appear for 1st level, Foundation one must have passed 10th from a recognized board.

To appear for the 2nd Level, Strategic Professional one must have completed the 1st level or must have +2 qualification from a recognized board. A minimum of 50% in other subjects and an aggregate of 65% in Mathematics/Accounting and English.

CA: To appear for CA Foundation one must have a 10+2 qualification from the recognized board.

To appear for CA intermediate one must complete CA Foundation or secure a minimum of 55% in commerce graduate or postgraduate and 60% in case of Non-Commerce.

ACCA or CA, which is harder?

CA is considered harder than ACCA in terms of levels, papers, and exams. No worries, Arivupro Academy will assist you to clear your CA exams at all three levels. Students at Arivupro have cleared their exams with good marks. When you pass CA, your name becomes more prestigious and you demand a lot of respect from others.

ACCAs or CAs earn more?

ACCA and CA are the professions that demand high pay as they hold so much knowledge which helps in the smooth operations of a company. The average salary of ACCAs in India is around 5-6 lakh per annum, and in the US, the average salary is around 48 lakh INR per annum. While deciding the salary of ACCAs in the UK, factors like Experience, qualification, industry, location, and the organization will be considered. When we talk about CAs, the average salary of CAs in India is 7-8 lakh per annum, and the highest salary package for CA in an international posting is 76 lakh per annum. In determining salaries, experience, organization, and location will be taken into account.

What is the most advantageous course: ACCA or CA?

1. You can pursue an articleship for ACCA while taking exams, allowing you to complete the course within three or four years. In the case of the Chartered Accountant, you can only pursue articleship after completing both groups of CA Intermediate.

2. An ACCA will typically earn approximately Rs. 5.6 lakhs per year, whereas a CA will earn approximately Rs. 8 lakhs per year ( Average starting salary).

3. The ACCA course can be completed in a shorter period compared to CA.

4. ACCA is a globally recognized certification, while CA has a monopoly in India as it specializes in the Indian Tax and Accounting system.

5. In terms of cost, ACCA is more expensive as it is based in the UK.

6. CA is considered to be the most challenging in terms of difficulty.

CA and ACCA are comprehensive courses covering various aspects required by finance professionals. Professionals with these qualifications can work in retail, individual, government bodies, non-profit organizations, and business houses. They can specialize in areas such as taxation, accounting, auditing, finance, financial analysis, etc. Thus, CA and ACCA courses are important in ensuring the smooth functioning of organizations.

Is it possible to do ACCA and CA at the same time?

If you wish to pursue both CA and ACCA simultaneously, you must plan your approach most efficiently. The choice ultimately depends on your perspective. One recommended approach is to start with CA and complete the CA Intermediate level before simultaneously taking up the ACCA course. This is feasible because ACCA offers more flexibility compared to the structured levels of CA. There are no groupings involved in ACCA, and once you finish the CA Intermediate level CA, you will have a two-year timeframe to complete your articleship before beginning the CA final level. During this period, you can also start preparing for the ACCA exams.

There are some common papers between CA and ACCA, which can enhance your performance in both courses. However, ACCA covers a broader range of topics, including finance, accounting, and managerial aspects of business. It is your responsibility to ensure that you allocate sufficient time and effort to excel in both sets of exams. By completing the CA Intermediate level CA, you will already have a foundation that will facilitate your understanding of the fundamental concepts in ACCA. Similarly, the professional level of ACCA will enhance your confidence when attempting the CA final exams. Undertaking both qualifications simultaneously requires a strong commitment and dedication on your part. Your success will depend on how determined you are to pursue both CA and ACCA.

Once you have completed the ACCA professional level, you can proceed to the CA final level. It is worth noting that both qualifications can count as the same three years of work experience. With a positive mindset and good mental health, you can achieve your dreams. Keep your passion and determination alive, and remember that consistency is key to success.